Increased shipping fees, extra labor costs, marketing, and covering returns can skyrocket the total Black Friday costs for e-commerce retailers.

The Hidden Costs of Black Friday for e-Commerce Retailers

Black Friday is one of the most (if not THE most!) important and busy periods in e-commerce. This year, Bain predicts a record of $75 billion in Black Friday sales for the US. Alongside promising significant profits for retailers the biggest discount event also provides the opportunity to get rid of old and unnecessary stock.

But is this what happens in reality?

The truth is the cost for e-commerce retailers can often be so high that it eventually hurts profits. While getting excited about the benefits of a huge sale is easy, retailers should not ignore the associated costs. If neglected, they might turn into a financial nightmare.

This blog post will help you identify and understand these costs so you're better prepared for the upcoming Black Friday period. If you're well acquainted with them, chances are you'll be able to shape your discount strategy in a way that's profitable and efficient.

Here's what's included:

- Black Friday's impact on e-commerce operations

- Increased shipping costs

- Marketing costs

- Payment processing fees

- Extra labor costs

- Covering returns

Let's dive in!

Black Friday's impact on e-commerce operations

Black Friday has been among the top 2 shopping events since 2019—some years it hit the No.1 spot and some years it took No.2 following the day before Christmas. Data about revenue from past years indicates a more than 200% increase during Black Friday compared to the off-peak shopping period.

The increased demand during Black Friday creates significant challenges for retailers. It impacts all operational aspects including transportation, warehouse and inventory management, labor resources, marketing, customer support, reverse logistics, and more.

Additionally, it leads to delays and difficulties in handling the spike in order volumes, and the associated returns and refunds. To be honest, I've never seen a brand that wouldn't send a disclaimer that "Due to large order volumes you can expect delays" or something similar during the Black Friday period.

So what kinds of costs does this situation create for retailers?

Increased shipping costs

Delivery 3PL companies like UPS, USPS, and FedEx apply additional peak season fees to handle the increased workload. While each company's fees are different, on average they increase the total shipping costs by 20–30%.

For example, UPS applies peak season surcharges for the peak season (including Black Friday, Christmas, and New Year) from Oct. 27, 2024, until Jan. 18, 2025, as follows:

UPS Peak Season Surcharges for 2024

| Service Level | Oct. 27, 2024 until Nov. 23, 2024 | Nov. 24, 2024 until Dec. 28, 2024 | Dec. 28, 2024 until Jan. 18, 2025 |

|---|---|---|---|

| UPS SurePost® | $0.25 per package | $0.50 per package | $0.25 per package |

| UPS Ground Residential | $0.25 per package | $0.50 per package | $0.25 per package |

| UPS Next Day Air | $1.00 per package | $2.00 per package | $1.00 per package |

| All Other UPS Air5 | $1.00 per package | $2.00 per package | $1.00 per package |

In addition to peak season fees, e-commerce retailers are sometimes pressured to use more expensive expedited delivery methods to catch up with delivery deadlines.

In other cases, retailers outsource part of the orders to a 3PL company that is not their usual delivery partner. This is a great measure to handle the temporary increase in shipping volumes, but working with a delivery company you don't have a long-term contract comes at an extra cost.

Moreover, covering the cost of failed deliveries is expensive too. According to a study, the average cost in the US is $17.20 per order and the failed delivery rate is 8%.

Marketing costs

Marketing is a huge cost for e-commerce retailers during the Black Friday period, yet it's key to success—without a sufficient marketing budget, any Black Friday campaign is doomed to fail.

Of course, there are some growth hacks and organic approaches that can spare (some of) the cost, but they require tons of creativity and expertise and are not applicable to every business niche. So, in 99% of the cases, you need a budget.

Paying for ads, promotional content, website rebranding, etc, is expensive per se, and during Black Friday it's even higher. The reason for this is that brands try to squeeze the most out of a short period of time and because competition is severely fierce. And more competition means higher ad prices. Additionally, each year prices go up which makes marketing even more expensive.

Here's some valuable data reported by Good Rebels, a digital marketing agency, and Triple Whale, an e-commerce automation platform provider:

- Meta ads are 43% more expensive in November compared to other months;

- Display ads are 32% more expensive in November compared to other months;

- Nearly 95% of all ad spend is dedicated to Meta and Google;

- Google Ads’ CPM increased from $15.69 to $19.03 (2023 vs 2022);

- Brands with <$1M in annual revenue spend more on marketing than brands making over $50M in annual revenue;

So, eventually, on top of prices rising each year, profit margins decrease due to discounts but marketing costs skyrocket due to competition—an unpleasant situation that requires careful strategy and approach to eventually report wins rather than losses.

Payment processing fees

Мore payments mean more processing fees—ranging between 2% and 3% of the transaction amount, depending on the payment processor or gateway. To put it in perspective, imagine that for $1 million in revenue, a retailer would pay $20,000–$30,000 in fees at standard rates.

While the percentage is usually fixed and lower prices mean lower net fees, discounts do impact profitability, because the fee grows as a percentage of the profit. Let's look at this example, where the production of the item (Cost of Goods Sold) costs $10:

| Scenario | Selling Price | Cost of Goods Sold (COGS) | Gross Profit | Net Fee (3%) | Net Profit | Fee as % of Profit |

|---|---|---|---|---|---|---|

| Regular Price | $100 | $10 | $90 | $3 | $87 | 3.33% |

| 50% Discount | $50 | $10 | $40 | $1.50 | $38.50 | 3.75% |

| 65% Discount | $35 | $10 | $25 | $1.05 | $23.95 | 4.2% |

From the example, we can see that the fee grows as a percentage of the profit as the discount increases. So to stay profitable, you need to consider your discounts carefully (although, not offering unreasonable discounts is one of the most common mistakes retailers make).

Another situation in which payment processing fees hurt profits is when chargebacks occur. Chargebacks are reverse payments that return funds from the retailer to the customer. Chargebacks happen due to various reasons such as:

- fraud and unauthorized transactions

- incorrect charges due to technical reasons

- the customer was charged by a merchant for items they never received

Usually, retailers cover the cost of a chargeback. The cost can range from $10 to $100+ in some specific cases, meaning sometimes the chargeback fee can exceed the value of the transaction.

In any case, payment fees are a huge financial burden and e-commerce retailers need to consider them carefully if they're serious about making profits during Black Friday.

Extra labor costs

During Black Friday many retailers need extra workforce and/or working hours to meet the demand. This results in hiring temporary workers and/or paying for overtime hours to existing employees.

According to the National Retail Federation, retailers plan to hire between 400,000 and 500,000 seasonal workers for the 2024 holiday season. While this number includes Black Friday and Christmas, it still indicates the increased workload. In addition, skilled workers are scarce so retailers need to offer competitive wages and additional benefits to attract them. This results in extra costs for retailers.

Overtime, on the other hand, is another big cost during Black Friday. Earlier this year the Biden administration suggested expanding overtime pay for salaried workers who make below $43,888 a year. While this suggestion was eventually rejected, retailers still need to pay extra if the workweek exceeds 40 hours.

Covering returns

Returns are another big chunk of the Black Friday-related costs. If the retailer fully covers the return (which is often the case and pretty much expected by the customer), the costs are huge.

A report by NRF from last year states that e-commerce returns in the US had an average return rate of 15.4%. For comparison, brick-and-mortar stores had a much lower return rate of 10.02% which indicates the huge pressure that e-commerce retailers face.

While returns are a natural part of e-commerce, the returns during Black Friday are way more compared to the off-peak shopping season. The reasons are most often the impulse buying and buyer remorse that come along with big discounts. Other common reasons for e-commerce returns include wrong sizes, quality issues, and a better price found elsewhere.

Conclusion

Being aware of hidden costs is pivotal for the financial success of a Black Friday campaign. While a discount strategy might seem pretty straightforward at first glance, missing the details might lead to failure.

E-commerce retailers that want to witness gains instead of losses during Black Friday must carefully consider all factors that affect profits. The devil is in the details they say—from the increased shipping costs to extended marketing budgets, extra labor pay, and covering returns and payment processing fees.

We hope that this blog post helped you understand these hidden costs better. And since you've come that far, thank you for reading!:)

Never miss a post

You may also like…

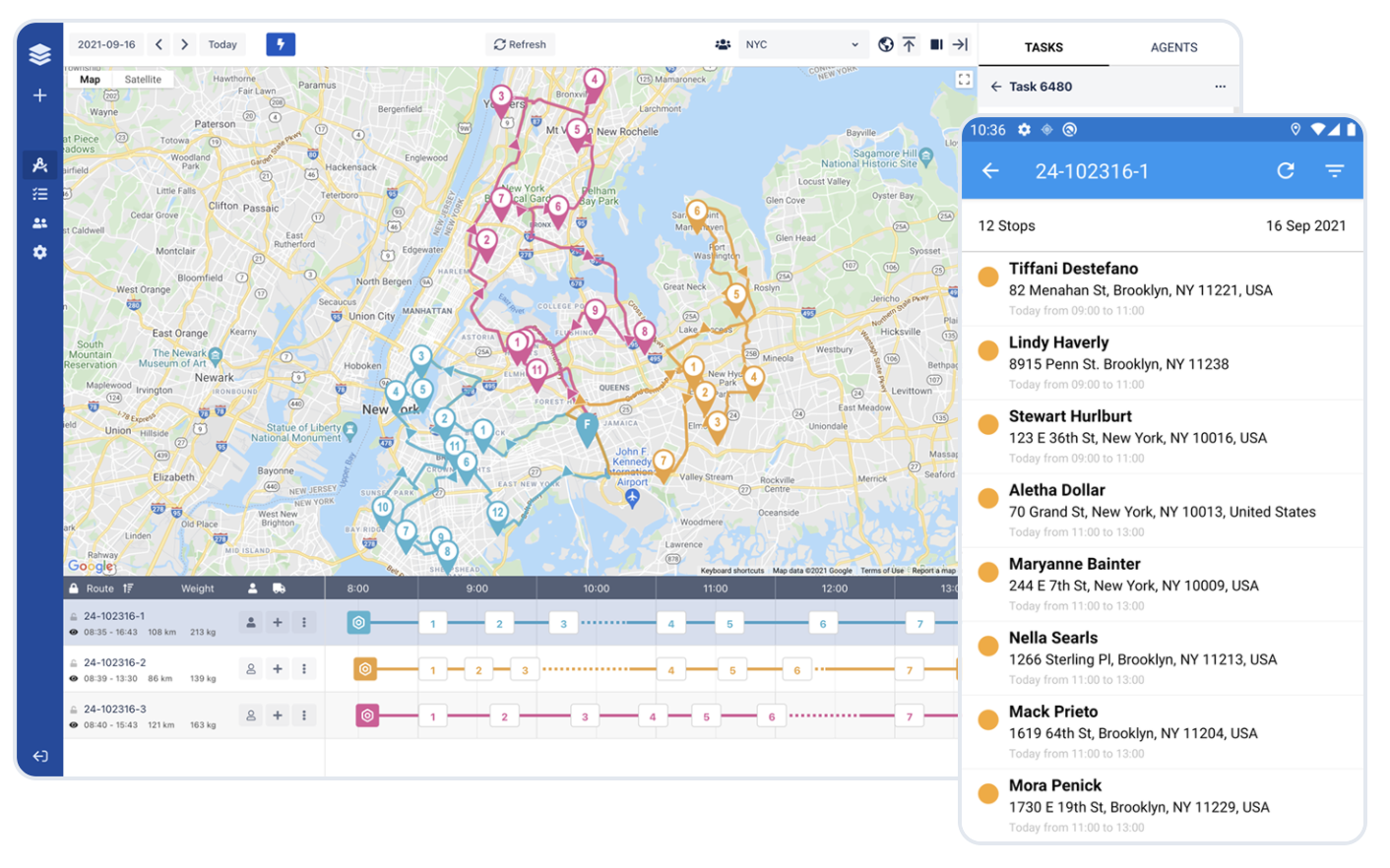

You too can reduce costs and improve efficiency with Ufleet

- plan and optimize delivery routes

- manage and empower drivers

- enhance customer experience

- make data-driven business decisions

We’d love to learn about your challenges.

Leave your email and we’ll get back to you.