Discover how failed deliveries impact ecommerce retention and brand equity—plus the KPIs and workflows top brands use to fix it.

For ecommerce brands, delivery is not a back-end operation. It is the most visible part of your customer experience. A missed ETA or a broken box breaks customer trust. And when trust erodes, brand equity and revenue follow.

In this post, we'll dive into how failed deliveries affect ecommerce brands beyond surface-level costs. You’ll learn which metrics reveal damage early, how top-performing ecommerce merchants respond to delivery exceptions, and what investments actually improve customer retention.

Why the Ecommerce Delivery Experience Is a Brand Issue

Shoppers don’t see fulfillment partners, shipping APIs, or third-party carriers. They see your brand. When delivery fails, they blame you even if it was the carrier's fault. And eventually shoppers disengage. This disengagement shows up in measurable ways: lower repeat purchase rates, negative reviews, and higher acquisition costs to replace lost customers.

Even if your product quality is exceptional and your customer service responsive, a single poor delivery experience can outweigh all of that. The margin of error in last-mile logistics is small, but the consequences are long-term. And for brands scaling via paid acquisition, each failed delivery devalues your entire CAC investment.

Let's talk numbers: 33% of consumers will stop buying from a retailer after just one poor delivery experience (Convey, 2022).

The Revenue Impact of Failed Deliveries

Most ecommerce brands measure shipping performance by tracking fulfillment times, carrier SLAs, and delivery costs. But this only captures operational efficiency. To understand brand impact, you need to go deeper into post-delivery customer behavior.

- Repeat purchase intent drops up to 70% after a negative delivery experience (Narvar, 2023)

- Failed deliveries often neutralize entire CAC investment, especially with first-time buyers

- Negative delivery experiences are shared more often than positive ones, increasing reputation risk

Let’s break this down: assume you spend $40 to acquire a customer. If the delivery fails and that customer churns, not only have you lost potential lifetime value—you’ve increased your blended CAC across all active buyers. Now imagine this happening at scale across hundreds or thousands of orders. The downstream cost is invisible in most P&Ls but critical for margin preservation.

Add to this the hidden friction it causes in your funnel. Customers burned by poor delivery often bounce from your emails, unsubscribe from SMS, and disengage from your retargeting. Over time, these signals degrade overall channel performance.

How Delivery Failures Undermine Customer Trust

Customers interpret delivery outcomes as brand behavior. When a package is late, damaged, or misrouted with no communication, it signals disorganization. If there’s no apology or resolution, it interpreted as indifference.

And unlike other aspects of the buyer journey, delivery is emotionally loaded. The customer has already paid. Their expectations are set. What happens next either reinforces your brand or undermines it.

Holiday delivery failures are particularly damaging: 64% of shoppers say they won’t return to a retailer after a missed holiday order (Deloitte, 2021).

Brands that treat delivery as an afterthought rarely grow customer lifetime value. Conversely, brands that invest in reliable fulfillment, transparent tracking, and proactive communication tend to outperform on retention, even if their products aren’t the cheapest.

The Right Metrics for Evaluating Brand Risk from Delivery

Delivery KPIs like “on-time percentage” or “average delivery days” are helpful but incomplete. To assess brand impact, focus on customer-centric metrics that connect delivery outcomes to behavior and perception:

1. Delivery-Related Churn

Tracks customers who stop buying after a delivery issue. This metric helps identify revenue leakage tied directly to fulfillment performance.

- Target: Less than 5%

- Red flag: Anything above 10% suggests systemic trust erosion

2. Time to Resolution (TTR)

Measures how quickly your support team resolves a delivery complaint. Fast resolution limits damage; slow responses increase the chance of permanent churn.

- Best-in-class: Under 6 hours

- Risk zone: Over 24 hours

3. Post-Incident NPS

Surveys customers who experienced a delivery issue and compares their Net Promoter Score to those with normal experiences. This “delta NPS” quantifies the reputational damage of logistics failures.

By layering these metrics, ecommerce leaders can create a delivery experience scorecard that highlights the true cost of failure and benchmarks the brand’s ability to recover trust.

How Top Ecommerce Brands Handle Delivery Failures

Smart brands don’t wait for delivery issues to become complaints—they intercept them early. Here’s how:

Proactive Exception Handling

Set up automation to flag failed deliveries, missed scans, or stalled shipments. Use real-time alerts to notify support, trigger customer messaging, and escalate internally if needed.

Segmented Recovery Playbooks

Not all customers should be treated equally. First-time buyers, high-LTV accounts, and subscribers should be prioritized. Segment recovery workflows based on value and risk.

- First-time buyer: Fast apology, ETA update, possible credit

- Loyal customer: Priority resolution, personalized message, loyalty offer

Compensation That Converts

Offering a $10 credit or free express shipping on the next order is more than damage control. It’s an investment in lifetime value. When offered strategically, recovery incentives drive repeat conversion and improve retention.

Case study: A DTC beauty brand reduced churn from first-time buyers by 42% after implementing automated delivery incident recovery with a 6-hour SLA.

Why Delivery Experience Is Core to Brand Equity

Your marketing sets the promise. Delivery is where the promise is either kept or broken. Most customers don’t care who shipped the product. They care whether they got what they paid for, on time, and without hassle.

In competitive ecommerce categories, operational trust is a key differentiator. Price and product may get the first sale, but reliability gets the second, third, and fourth.

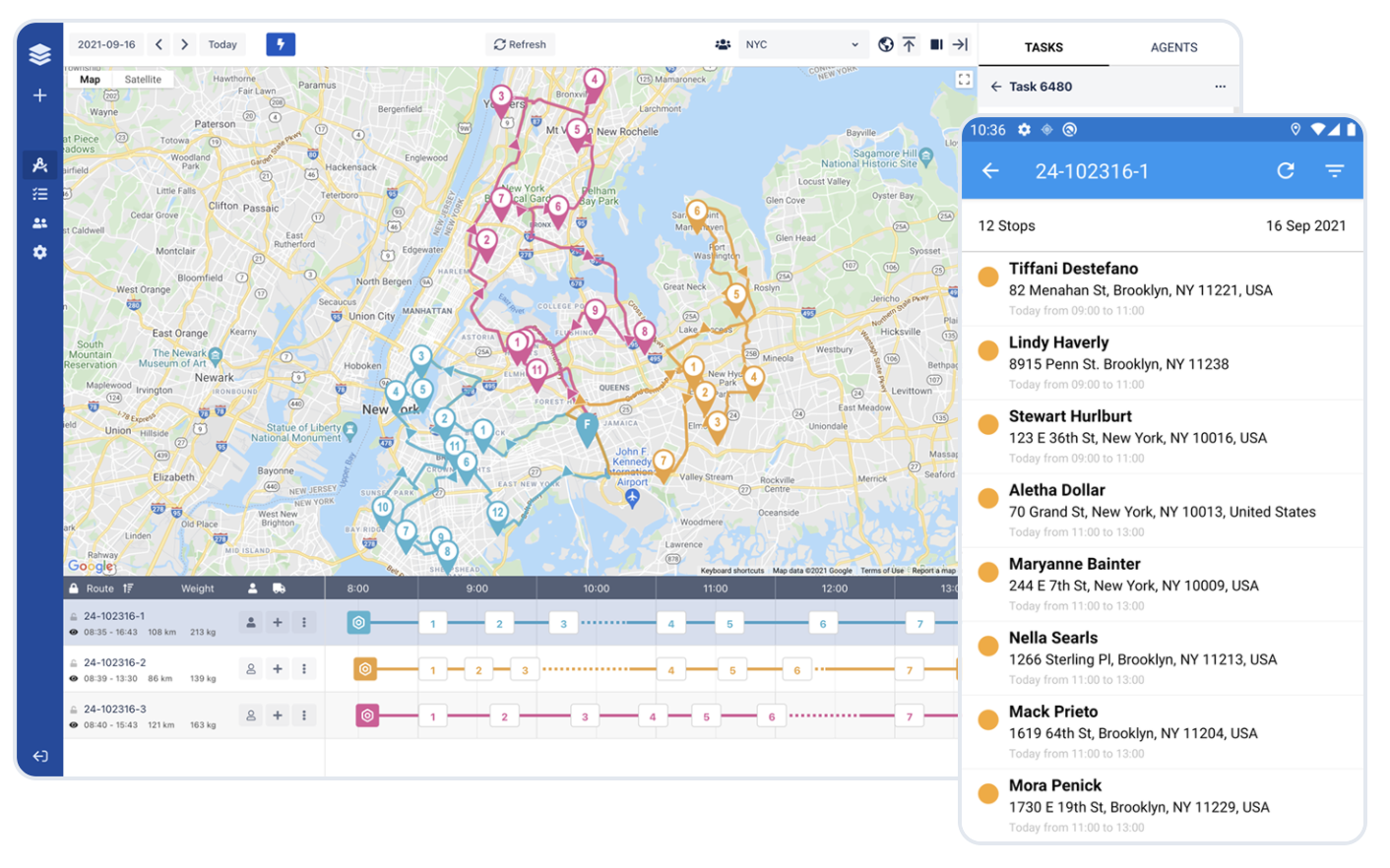

Retailers who invest in logistics precision—route optimization, live tracking, ETA transparency, and support automation—see stronger loyalty, better retention, and higher net margins. And the brands that fail to take control of the post-purchase experience increasingly find themselves trapped in the cycle of rising CAC and high churn.

Final Thought

Delivery is the last touchpoint in the ecommerce journey—but the one customers remember. The cost of bad delivery is lost trust, lost revenue, and lost growth potential.

Merchants who win in 2025 will be those who treat delivery as a core part of their brand - not just as a fulfillment problem to solve, but as a customer experience to own.

Never miss a post

You may also like…

You too can reduce costs and improve efficiency with Ufleet

- plan and optimize delivery routes

- manage and empower drivers

- enhance customer experience

- make data-driven business decisions

We’d love to learn about your challenges.

Leave your email and we’ll get back to you.