Despite inflation and rising interest rates, sales during the 2023 holiday season were high. This also resulted in a high number of returns.

Sales and Returns: Insights from 2023 Holiday Shopping

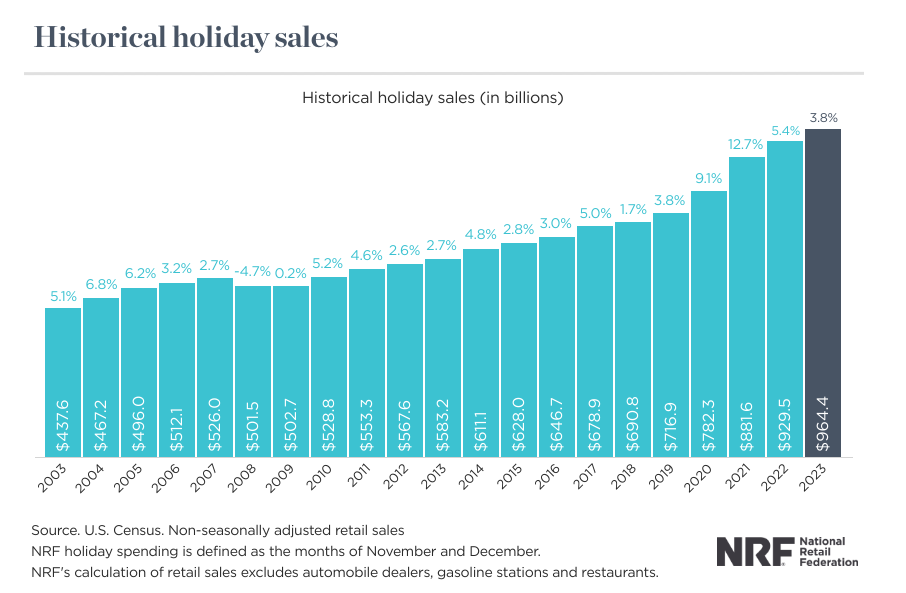

The 2023 holiday shopping was particularly impactful for retailers with sales growing 3.8% over the previous year, reaching a record high of $964.4 billion!

This surge, driven by events like Black Friday and Christmas holidays, inevitably led to a significant rise in returns too.

In this blog post, we’ll provide you with key retail insights from the 2023 holiday shopping season. We’ll also dive into the impact of returns and refunds.

Here’s a brief overview:

- Sales results from holiday shopping

- Environmental impact of holiday shopping

- Consumer behavior insights

- Impact of returns and refunds on retailers

- Challenges of returns and refunds for retailers

- Financial impact from returns and refunds for retailers

Let’s dive into it!

Sales results from holiday shopping

Jack Kleinhenz, Chief Economist at the National Retail Federation, said that US consumer spending was incredibly resilient in 2023 despite inflation and high interest rates.

Holiday sales alone scored a record $964.4 billion in 2023. For comparison, in 2022 holiday shopping reached $929.5 billion. According to NRF, the holiday season includes the period between November 1 and December 31.

The increase in US consumer spending creates opportunities for retailers to boost revenue and clear inventory. However, it also creates challenges, such as managing high traffic in stores and online platforms, ensuring adequate stock levels, and handling logistical demands.

Environmental impact of holiday shopping

The rise in sales inevitably leads to environmental concerns, particularly in packaging and shipping.

The increase in holiday shopping leads to an abundance of packaging material. This surge results in more cardboard plastic, and other materials that often end up in landfills.

Delivery, on the other hand, contributes significantly to increased carbon emissions. The environmental cost is extremely high due to the high volume of orders and expedited shipping demands.

Retailers are increasingly focusing on sustainability practices to address these issues, but the problem is still present.

US Consumer behavior insights

Despite concerns over inflation, US consumer spending remained strong in 2023. The average American planned to spend $831 on holiday gifts.

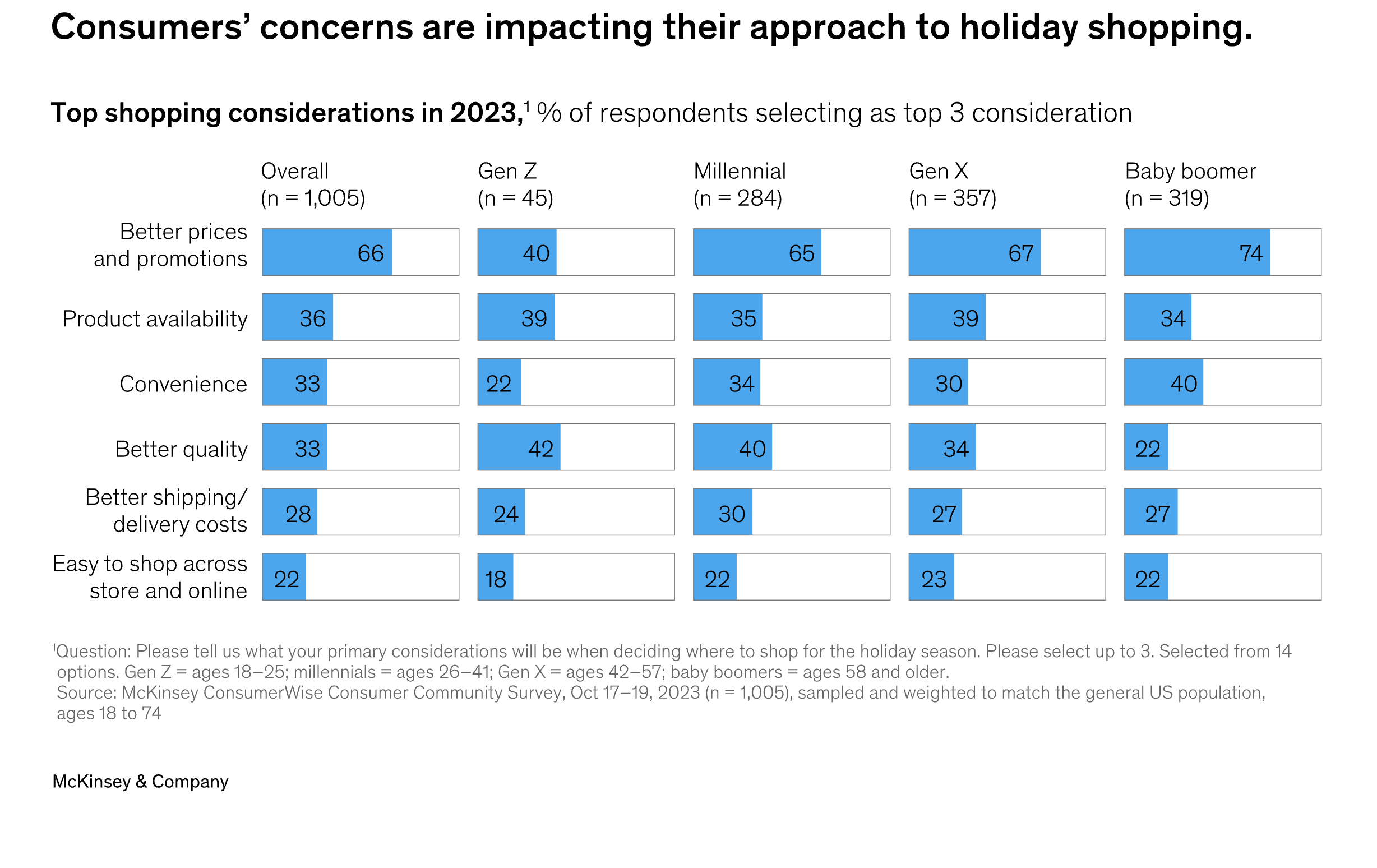

Prices and promotions were the top buy factors for the majority of shoppers this year according to McKinsey. The only exception was Gen Z who ranked product quality being slightly more important than price and discounts.

There was a 12% decrease in the intention to splurge among Gen Z. However, this demographic still planned to spend more than the previous year, focusing on categories like apparel, beauty, and electronics.

Shoppers from all generations preferred to use credit cards as a payment method. And while the debit card was the second choice for Baby boomers, Gen X, and Millennials, Gen Z preferred the Buy Now, Pay Later payment method.

Shopping dynamics also included an increase in online sales. The convenience, variety, and competitive pricing were often among the driving factors. The most used channels for online shopping research were retailers' websites and apps.

This shift creates the need for retailers to improve their online presence, optimize their websites for seamless user experience, and ensure efficient delivery and return processes.

Impact of returns and refunds on retailers

The NRF projected a 7% to 9% increase in online sales. Such an increase naturally leads to a higher volume of returns and refunds.

Handling returns is a challenging and important task for businesses because it directly impacts customer satisfaction and how much profit a business makes.

While complete data on the volume of returns from the 2023 holiday season is not yet available, the trend suggests a significant number. A report by NRF from 22 December 2023 states that returns in the US had an average return rate of 15.4% of total sales.

For context, online sales from the entire year have a return rate — 17.6% or $247 billion, compared to 10.02% or $371 billion for brick-and-mortar returns.

The reasons for returns vary, but common issues include purchasing the wrong size, mismatched expectations, and buyer's remorse.

Customers often struggle to select the correct size when shopping online, especially when it’s a gift for somebody else. The real product might also differ from online descriptions or images.

Buyer's remorse, on the other hand, is often observed with impulse purchases. After the excitement of the purchase fades, consumers may reconsider their need or desire for the product.

Challenges of returns and refunds for retailers

Returns include numerous steps like sorting, inspecting, and restocking or disposing of returned items. This complexity creates plenty of challenges for retailers.

Handling a large number of returns is a huge logistical issue with a significant cost impact. Retailers need to deal with transportation capacity, warehouse space limitations, and labor availability.

Meeting customer expectations is also key. Timely communication, easy-to-follow return procedures, and quick processing of refunds are far from easy with large volumes of returns.

The workload from holiday returns is huge, and can often impact the business dynamics several months in a row. While retailers cannot fully avoid it, they can significantly forecast and streamline the return process.

Systems for processing returns, real-time inventory management, and data analytics tools can help retailers predict return patterns and automate operations.

Financial impact from returns and refunds for retailers

According to NRF (data from 22 Dec 2023), returns in the US scored $148 billion, or 15.4% of total sales.

Returns have a significant financial impact on retailers. Retailers face both direct and indirect costs associated with returns.

Direct costs include shipping, handling, and processing expenses. Indirect costs can be more significant, such as lost sales, reduced profit margins, and the potential depreciation in the value of returned items, especially if they cannot be resold.

Returns additionally disrupt cash flow and financial forecasting. The unpredictability of returned stock can also lead to overstocking or stockouts of certain items.

While not a direct financial cost, returns impact customer satisfaction and retention. A poor return experience can lead to customer churn, which has a long-term impact.

Key takeaways

The 2023 holiday shopping season brought both opportunities and challenges for retailers.

The retail industry saw significant growth with record sales of $964.4 billion. However, this success also comes with an increase in returns and refunds, presenting logistical and financial hurdles.

Understanding consumer behavior, such as the preference for online shopping and the use of credit cards, is crucial for retailers to adapt to changing market dynamics.

The shift toward sustainability and the need for efficient online presence and return processes are also key takeaways from this season.

If you found this post helpful, hit the subscribe button to receive similar insights straight in your inbox.

Never miss a post

You may also like…

You too can reduce costs and improve efficiency with Ufleet

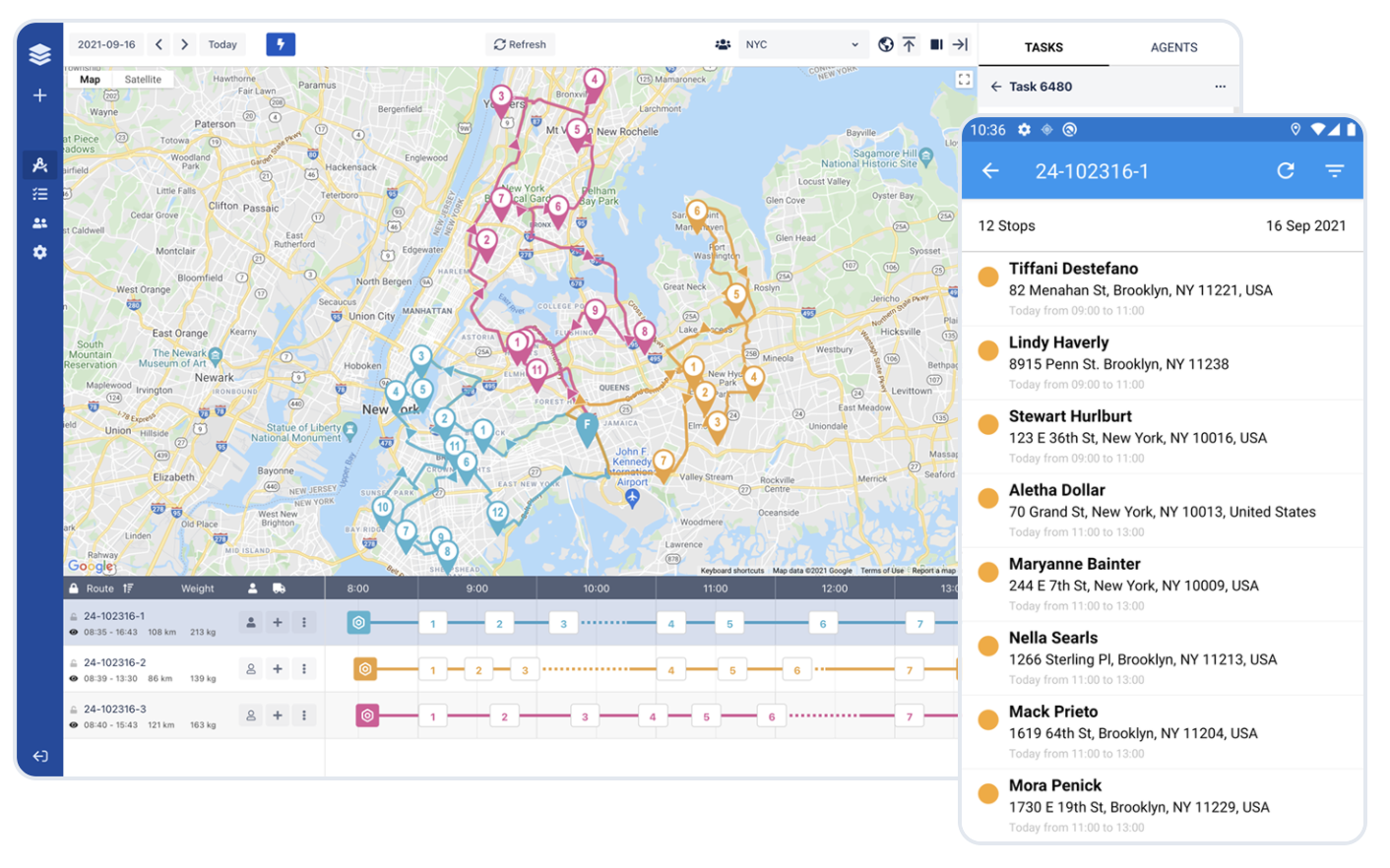

- plan and optimize delivery routes

- manage and empower drivers

- enhance customer experience

- make data-driven business decisions

We’d love to learn about your challenges.

Leave your email and we’ll get back to you.