Hongkong Post announced a full suspension of its parcel services to the US. For ecommerce businesses, this will impact fulfillment, warehousing, and last-mile delivery.

Suspension of Hongkong Post Services: What It Means for US Logistics

On April 16, 2025, Hongkong Post announced a full suspension of its parcel services to the United States. For ecommerce businesses operating in the US, this is a seismic shift with ripple effects across fulfillment, warehousing, and last-mile delivery.

Triggered by tightened US trade rules, and specifically the removal of the de minimis threshold that once allowed duty-free entry for goods under $800, this decision marks a new era in cross-border ecommerce and delivery.

Here's how this global change will impact reshape domestic logistics and what your business can do to stay ahead.

1. Shift towards domestic fulfilment

Many ecommerce businesses have used Hong Kong as a springboard into the US market because it allowed cheap, direct shipping with minimal customs friction. That era is over.

With direct-to-consumer shipping cut off, sellers will now need to position inventory within the US. This will drive a sharp rise in demand for domestic fulfillment methods, including:

- 3PL partnerships that offer warehousing, pick-and-pack, and delivery

- Hybrid models where sellers lease small warehouse space and self-manage delivery for high-margin zones

- Amazon-style fulfilment where inventory is pre-positioned closer to demand

This shift is both operational and financial. A seller that used to ship $12 packages directly from Asia now needs to factor in US storage fees, local transportation, and last mile delivery overhead. Without proper planning, margins will erode quickly.

2. Last mile delivery demand will spike. Fast!

Storing goods in the US solves one problem but creates another: how to get those goods to customers quickly and affordably.

Expect last-mile delivery volume to rise significantly in Q2 and Q3 2025. For small to mid-sized ecommerce businesses, especially those operating regional warehouses, this creates a decision point:

- Outsource to USPS, FedEx, or UPS and pay per-parcel fees

- Operate your own local fleet and gain cost control, flexibility, and brand experience

Read about the pros and cons of each option here.

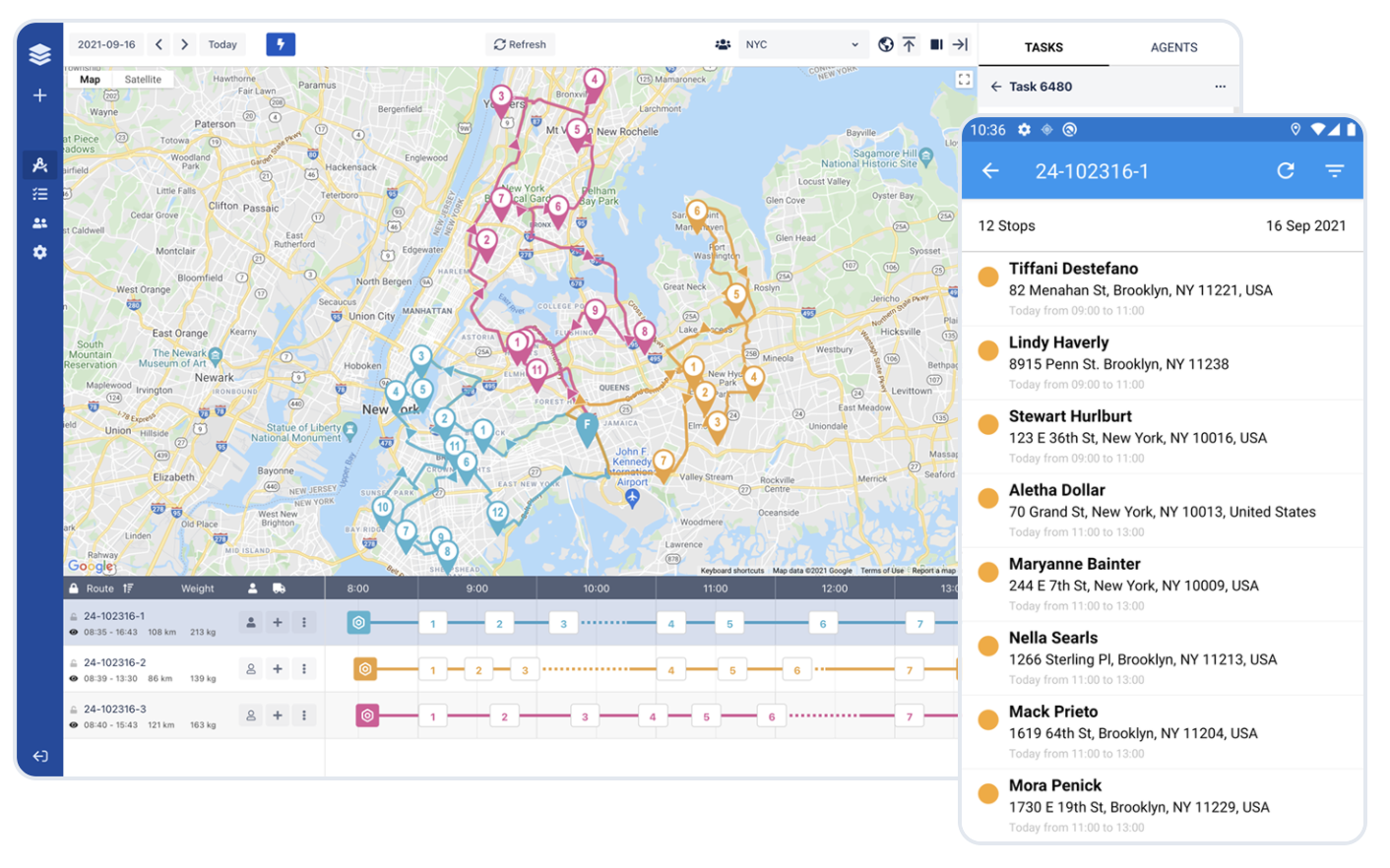

If you have 50+ local deliveries per day, self-delivery starts to make financial sense—especially in dense urban areas where time per stop is low. But without the right tools, the complexity can overwhelm your team. Route optimization tools like Ufleet can help.

3. More cross-docking and consolidation

With small-parcel shipping gone, international sellers will shift toward bulk freight into US ports. This means more:

- Consolidated container loads shipped to East and West Coast hubs

- Cross-docking centers that sort and dispatch products for regional delivery

- Freight-forwarder partnerships managing customs, inland transport, and warehousing

Cross-docking isn’t new, but it’s becoming critical infrastructure. Businesses that once skipped these steps now need to think like logistics operators—timing inbound shipments, coordinating outbound vans, and syncing delivery schedules across zones.

📌 Expert Tip: Plan delivery windows backwards from customer expectations. If 2-day shipping is your promise, your cross-docking-to-doorstep window should be under 36 hours—including sorting and first-mile handoff.

4. Nearshoring is gaining ground

The Hongkong Post suspension is part of a larger trend: geopolitical tension and supply chain instability. As US-China trade friction grows, more companies are reconsidering where they source from.

Expect to see:

- Nearshoring to Mexico or Central America for apparel, electronics, and consumer goods

- Reshoring critical inventory to US facilities to reduce transit times

- Dual-sourcing strategies to hedge risk across multiple regions

Every sourcing decision impacts logistics. Shorter supply chains mean tighter inventory cycles, but also a heavier lift on domestic transport. Sellers who adapt their delivery operations in parallel with sourcing changes will gain speed—and resilience.

Final thoughts

The loss of direct mail from Hong Kong is not a temporary glitch. Ecommerce is entering a more complex, localized, and logistics-intensive era.

For businesses managing their own deliveries, this is a rare opportunity to leap ahead. The companies that invest now in intelligent delivery management—route optimization, fleet tracking, performance analytics—will outperform slower competitors still clinging to outdated fulfillment models.

Is your delivery operation ready?

Ufleet helps small businesses run smarter deliveries with fewer vehicles, lower costs, and better customer experiences.

Whether you’re shipping from a warehouse, cross-docking facility, or the back of your own store—we can help you scale with confidence. See how here or test the product for free.

Never miss a post

You may also like…

You too can reduce costs and improve efficiency with Ufleet

- plan and optimize delivery routes

- manage and empower drivers

- enhance customer experience

- make data-driven business decisions

We’d love to learn about your challenges.

Leave your email and we’ll get back to you.